Lael Oldmixon, Executive Director, Alaska 529

My name is Lael Oldmixon and I’m the Executive Director of Alaska 529. My team and I are very excited about the partnership we’ve formed this year with the Association of Alaska School Boards. Our missions are very much aligned. We are both working hard to ensure that every youth in Alaska is able to achieve their potential and is able to secure the education they need to get there. Education, in its many forms, is the foundation that all the achievements we want for our kids is built on. Some planning is needed to ensure that students are able to cover the costs of education and training after high school. This is where Alaska 529 can be a valuable resource.

For those of you not familiar with Alaska 529, let me share the basics. Alaska 529 is a tax-advantaged way to save money for future education expenses. Assets in the plan are invested and grow tax-deferred. If the account is used for its intended purpose, to pay for education expenses considered “qualified” by the IRS, any growth in the account is exempt from federal taxes. This means there is potential for your account to grow faster than a traditional savings account, because you do not have to dip into the account each year to cover taxes.

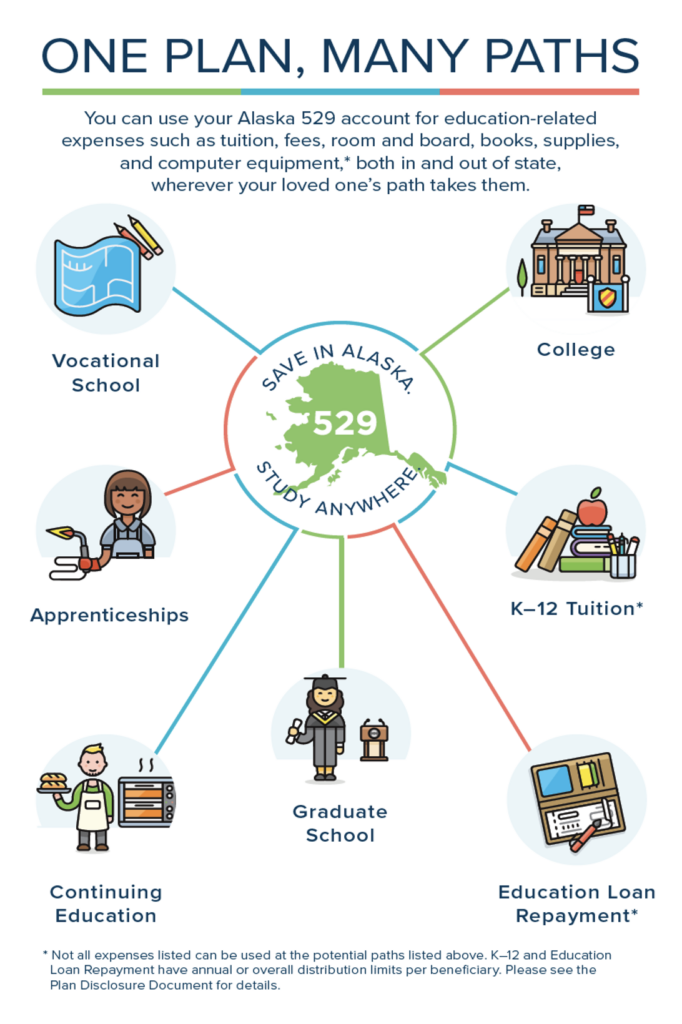

Though many associate 529 plans with “college savings,” the truth is that 529 accounts can cover costs far beyond those related to a traditional college degree. Today, you can use your account for all kinds of education-related expenses including tuition, fees, room and board, books, supplies, and computer equipment, both in and out-of-state. Let’s count the ways you can use a 529 plan.

1. K-12 Tuition: Use up to $10,000 annually for K-12 tuition at an elementary or secondary public, private, or religious school.

2. Apprenticeships: Use 529 savings to pay for fees, books, supplies, and equipment needed for on-the-job apprenticeship training with classroom instruction. All apprenticeships must be registered with the U.S. Department of Labor to qualify.

3. Vocational School: Use 529 savings for vocational or trade school, community colleges, and certificate programs to pay for qualified expenses, including tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions.

4. College: Use 529 savings for any college or university in the U.S. and some international schools to pay for qualified expenses, including tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions.

5. Graduate School: Use 529 savings for graduate school to pay for qualified higher education expenses, including tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions.

6. Loan Repayment: Use 529 savings to repay the principal and interest on qualified education loans. Tax-free 529 distributions are limited to a $10,000-lifetime cap when used to repay principal and interest on qualified education loans for an individual or their sibling.

7. Continuing Education: Use 529 savings to pay for continuing education credentials or degree programs to further career opportunities. Savings can be used towards tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions.

With such flexibility in terms of uses, one might actually wonder what can’t you use a 529 account for?

My goal may be lofty, but I would love for every young person in Alaska to have dedicated savings for their post-high school education. It seems to me that for two reasons, Alaska is more poised to achieve this dream than any other state. First is the fact that every Alaskan receives free money each year in the form of the PFD. It is easy to automatically invest a PFD in Alaska 529 (yet only about 2% of the population chooses to do so). Secondly, Alaska 529 offers a generous incentive program, awarding each new account holder/beneficiary relationship in the plan a $250 contribution. Between the annual PFD windfall and the incentive program, Alaskans have assets available to start building an account with very little out of pocket cash needed to get started.

Thank you for your devoted service to your communities and the next generation of Alaskans. I look forward to the accomplishments we can achieve together.

The views expressed here are the writer’s and are not necessarily endorsed by the Association of Alaska School Boards. AASB welcomes diverse perspectives and civil discourse. To submit a Guest Column for consideration, see our Guest Column Guidelines and email your 400-1000 word submission HERE.